Risk Compact Analysis

… some see more than others!Risk Compact Analysis

… some see more than others!

We prepare for you an accurate and reliable overview of:

- Your risks

- Your level of protection

- The market opportunities

Consultation with know-how

An independent analysis

Only you are our client. In preparing our analysis we are free from any influencing factors which might keep us from a professional consultation. We give ourselves whatever time is necessary to conduct an in-depth consultation. There are no insurers who could influence us in our work. Nothing prevents us from discussing with you ALL the points we find.

Only you are our client. In preparing our analysis we are free from any influencing factors which might keep us from a professional consultation. We give ourselves whatever time is necessary to conduct an in-depth consultation. There are no insurers who could influence us in our work. Nothing prevents us from discussing with you ALL the points we find.

You check the quality of your products

We check the quality of your insurance. The global ties between suppliers and customers require that the highest quality standards are achieved. Where your products and services are concerned, you have a quality control department with specialists. For the review of the quality of your insurance protection we are the experts. Looking at the matter from a different angle, coupled with a wealth of experience derived from hundreds of risk compact analyses and thousands of contracts in our portfolio as industrial insurance brokers, always leads to new insights. It is not for nothing that the four eyes principle is one of the most recognised methods of avoiding mistakes.

We check the quality of your insurance. The global ties between suppliers and customers require that the highest quality standards are achieved. Where your products and services are concerned, you have a quality control department with specialists. For the review of the quality of your insurance protection we are the experts. Looking at the matter from a different angle, coupled with a wealth of experience derived from hundreds of risk compact analyses and thousands of contracts in our portfolio as industrial insurance brokers, always leads to new insights. It is not for nothing that the four eyes principle is one of the most recognised methods of avoiding mistakes.

Systematic and speedy

The Gussmann analysis procedure

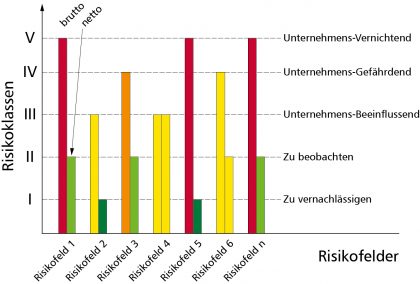

The core of our risk compact analysis is our gross/net analysis. In this process we evaluate your insurable business risks into five risk classes (see on right) and show you at the same time how you have up until now brought under control “risks with the potential to devastate your company” by means of preventative measures or insurance solutions.

The core of our risk compact analysis is our gross/net analysis. In this process we evaluate your insurable business risks into five risk classes (see on right) and show you at the same time how you have up until now brought under control “risks with the potential to devastate your company” by means of preventative measures or insurance solutions.

With risk check-lists which are adapted exactly to the size of the business in question, we first assess – without much effort or cost on your part – your current risk situation.

On the basis of these results we produce a holistic insurance concept for your business. We then compare our results with current security solutions. Of course, we then explain to you the improvement potential in detail and in a way that makes it easy to understand.

Concrete risk-avoidance

As our company has also made a name for itself in the field of risk management over decades, this is where we can take full advantage of a particular strength.

As our company has also made a name for itself in the field of risk management over decades, this is where we can take full advantage of a particular strength.

For most recognised weak points we can regularly deliver practicable and easily implemented suggestions for improvement.

To make the implementation easier for you, we document the circumstances and show you our solutions. Armed with this, it is easier for our clients’ operations managers and strategists to win over their colleagues to an idea.

With our approach we do not only turn to fire prevention topics but we report over the whole extensive range of the insurable risks.

Put it to the test!

There are some things which you don’t find out until you try them

The benefits of our analyses for the security of your enterprise:

- professional and independent assessment of your insurance cover

- implementable optimisation potential

- concrete approaches to direct loss prevention

- market overview of price formation for your business

- documentation with which you can convince your bank in matters of risk controlling

Flawless Documentation

We don’t leave you to puzzle over insurance jargon on your own. In our risk compact analysis we group all your current insurance cover together in an intelligible way. Moreover, we pick up point by point the areas of protection in need of optimisation. Of course, we present the results of our gross – net analysis and document the areas we have identified which can usually be optimised with little effort. If required, we also show the pricing options which have been identified by our call for tender.

Discuss your security and risk management needs with us

We would be pleased to answer all your questions on protection and risk minimisation.

+49 - 541 - 40 40 - 0